Correlation Between Business News and Stock Market Fluctuations

Welcome to a home for investors, analysts, and curious readers exploring how business headlines echo through prices, volume, and volatility. In Correlation Between Business News and Stock Market Fluctuations, we unpack signals versus noise, share timely case studies, and build habits that turn chaotic news flows into confident, disciplined decisions. Join the conversation, subscribe for weekly insights, and tell us which news catalysts you want decoded next.

Earnings Surprises Versus Rumors

Markets distinguish audited facts from whisper campaigns. When a company beats consensus earnings materially, both algorithms and humans rapidly reset fair value. Rumors, by contrast, often create anticipatory positioning, squeezes, and whipsaws. Share how you filter credibility, timing, and source quality before acting on a tantalizing hint.

Macroeconomic Announcements and Timing Effects

The minute of release shapes liquidity and slippage. Payrolls or CPI at 8:30 ET jolt futures before cash opens, while FOMC statements at 2:00 can compress correlations and widen spreads. Decide in advance whether you stand aside or engage. Tell us your plan, and get our calendar reminders by subscribing.

Sentiment Polarity and Volatility Clusters

Headline sentiment often maps to returns asymmetrically. Negative surprises can cluster volatility and spill into peers through supply chains or factor exposures. Track cross-sectional moves after news shocks and compare sector heatmaps over time. Subscribe to receive our weekly volatility clusters dashboard and contribute your own observations.

Building a News-to-Price Playbook

Classify News by Materiality and Time Horizon

Separate structural, multi-quarter changes from fleeting, tactical items. A new regulatory approval often alters long-term cash flows, while a product rumor might only drive intraday attention. Rank materiality, estimate duration, and align position sizing accordingly. Comment with your categories so others can learn and compare frameworks.

Create Catalyst Watchlists and Action Triggers

Build a calendar of known catalysts: earnings dates, guidance updates, antitrust decisions, and macro prints. Predefine triggers such as percentage gaps, option skew, or unusual volume. When news hits, you already know what to do. Share your favorite triggers, and subscribe for our monthly catalyst watchlist.

Case Studies: When Business News Shook the Tape

A late-Friday clinical hold landed after hours, instantly collapsing a mid-cap biotech by over a third in the premarket. Options implied volatility exploded, and suppliers with dependency exposure followed lower. The lesson: regulatory language can dominate fundamentals. Share how you protect against event risk in specialized sectors.

Case Studies: When Business News Shook the Tape

An unexpected CEO resignation surfaced at 7:12 am, triggering knee-jerk selling and analyst downgrades before the open. Yet the board’s simultaneous succession plan steadied sentiment by midday. The nuance: leadership transitions need context. Discuss how you weigh governance signals against initial panic when leaders change suddenly.

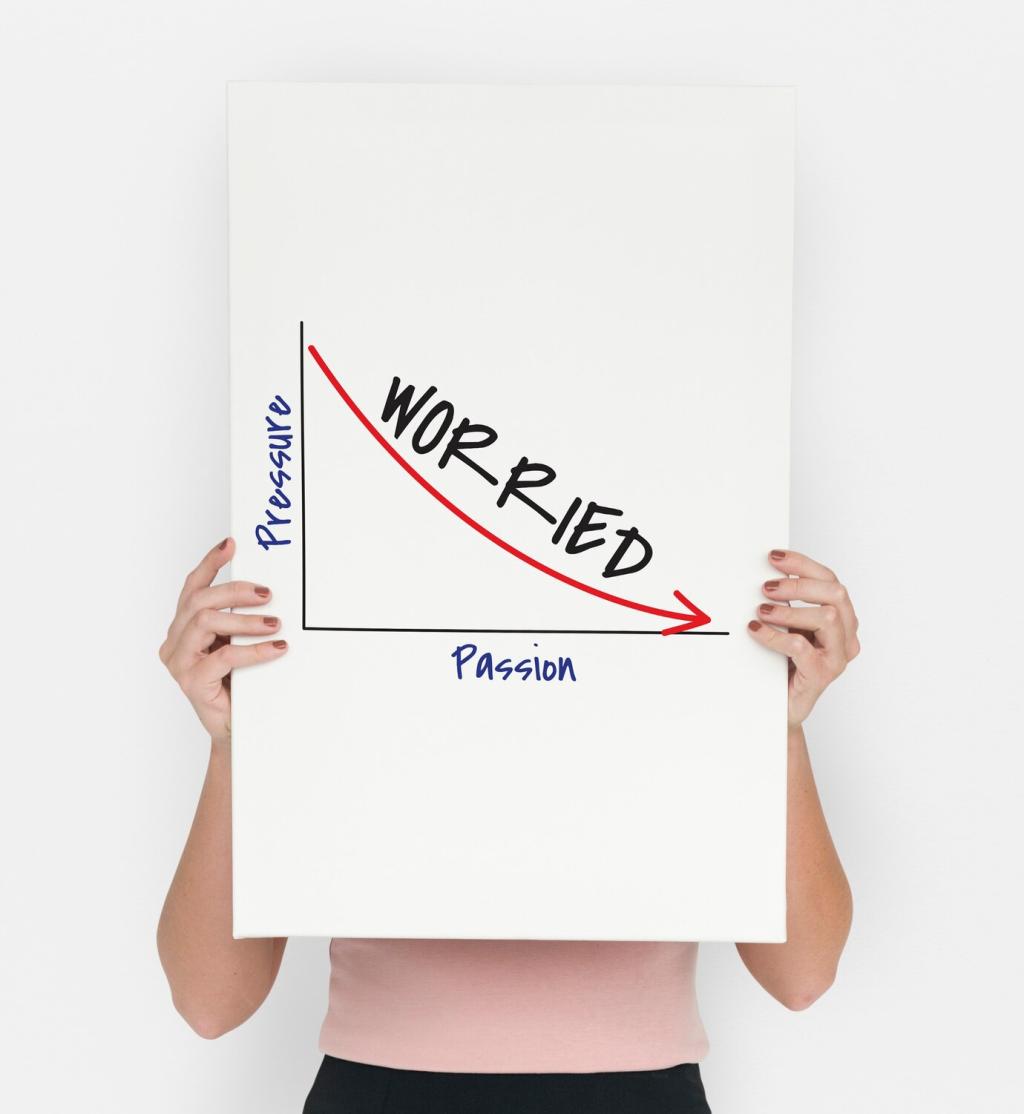

Narrative and Psychology: Why Stories Become Trades

Traders have limited bandwidth, so the loudest headline often wins the first trade. That can amplify overreactions, especially when liquidity is thin. Build routines that slow you down during storms. Tell us what tools you use to avoid chasing the first move when your pulse quickens.

Narrative and Psychology: Why Stories Become Trades

Small wording differences can shift perception dramatically. A ‘miss’ framed as ‘resilient despite headwinds’ softens the blow, while ‘unexpected’ amplifies surprise. Translate headline tone into measurable expectations. Share examples of framing that fooled you once, and help others spot similar traps faster.

Narrative and Psychology: Why Stories Become Trades

Social feeds can turn a niche update into a market-moving meme within minutes. Herding often compresses reaction time and magnifies intraday ranges. Track source credibility and dispersion across communities. Comment about your trusted sources, and subscribe to our curated news list to reduce noise.

Data and Tools for Tracking Correlations

Combine RSS, official filings, and sentiment APIs to tag headlines by ticker, entity, and polarity. Maintain timestamps precise to seconds and align them with trade prints. This foundation enables robust analysis later. Tell us your preferred providers, and we’ll compile a reader-powered comparison guide.

Data and Tools for Tracking Correlations

Centralize known catalysts with alerts for economic releases, earnings, and product launches. Layer nowcasts from alternative data to anticipate drift between events. With preparation, a surprise becomes manageable. Share the calendars you rely on, and subscribe to receive our weekly catalyst digest and reminders.